Bitcoin Price Rallies Above $70K: Is a New High Within Reach?

Bitcoin has recently surged above $70,000, increasing by over 5%. The cryptocurrency is trading above key resistance levels and is poised to potentially break through $72,000. With strong support levels identified and positive technical indicators, Bitcoin may be on the brink of setting new all-time highs, though caution is warranted should it fail to maintain upward momentum.

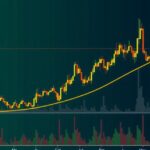

Bitcoin has recently surged past the $70,000 mark, witnessing an increase of over 5%. The cryptocurrency appears poised for further advancements, potentially surpassing the significant resistance at $72,000. After establishing a solid support baseline around $66,500, Bitcoin moved past the $68,000 threshold and has since shown resilience and upward movement. Currently, it is trading above $70,000, buoyed by favorable market conditions and the presence of a bullish trend line evident on the hourly BTC/USD chart. The price has reached $71,482, indicating robust bullish momentum, especially as it navigates above the critical 23.6% Fibonacci retracement level from its recent low. The technical indicators reflect Bitcoin’s strength, notably with the hourly MACD indicating a positive trajectory in the bullish zone, and the Relative Strength Index (RSI) exceeding the 50 level. Moving forward, attention will turn toward resistance near $71,500 and $72,000, with a clear breakthrough of the latter potentially propelling Bitcoin to test $72,200 and possibly challenge heights approaching $73,000 and beyond, with even speculation of a new all-time high at $75,000. Conversely, should Bitcoin encounter difficulty moving past the $72,000 resistance, a correction could ensue. The immediate support level is identified at approximately $70,500, with crucial support anticipated near $68,500 and potentially down to $66,500. Therefore, market participants should operate with vigilance, observing both resistance and support levels as Bitcoin navigates this critical trading period.

The cryptocurrency market is known for its volatility and dramatic price fluctuations. Recently, Bitcoin, the leading digital asset, has demonstrated a bullish trend, capturing market attention as it moves above significant thresholds. A deeper understanding of Bitcoin’s price dynamics involves monitoring key support and resistance levels, which guide potential price movements. As Bitcoin breaks through crucial resistance points, such as $70,000 and $72,000, the implications for investor sentiment and market behavior become pronounced. Historical price actions, Fibonacci retracement levels, and technical indicators play critical roles in forecasting future movements in this ever-evolving financial landscape.

In summary, Bitcoin’s recent rally above the $70,000 mark signifies renewed optimism among investors, suggesting potential upward movement towards new resistance levels. Market analytics point toward strong bullish trends supported by technical indicators. However, the volatility inherent in cryptocurrency trading necessitates caution, especially if price adjustments towards established support levels occur. Investors should remain attentive to market signals as Bitcoin continues to navigate this precarious yet promising phase of its trading cycle.

Original Source: www.tradingview.com

Post Comment