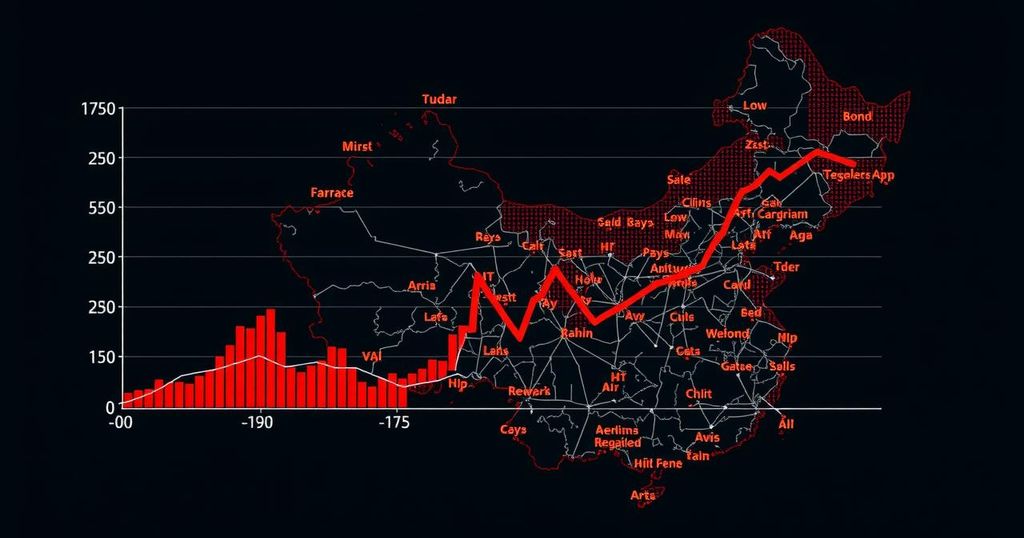

China’s 10-Year Bond Yields Fall Below 2% for First Time Since 2002

China’s 10-year bond yields have dropped below 2% for the first time since 2002, indicating investor concerns about prolonged low-interest rates amidst slow economic growth. This shift could have significant implications for future fiscal policies and investment strategies in China.

In a significant shift within China’s financial landscape, the yield on 10-year bonds has notably dipped below 2% for the first time since 2002. This decline reflects a growing sentiment among investors regarding the possibility of prolonged low-interest rates in the face of slower economic growth. Such a trend could influence broader monetary policy, as market observers speculate about the implications for both fiscal health and investment strategies within China’s economy. Investors are now closely monitoring indicators that may signal adjustments in the central bank’s approach to stimulating economic activity.

The decline in 10-year bond yields is a manifestation of various economic factors affecting China today. Historically, low yields are often indicative of investor confidence in a stable economic environment, but they may also signal concerns over economic deceleration. The Chinese government has been grappling with challenges such as trade tensions, domestic market fluctuations, and global economic uncertainty, prompting investors to reevaluate their strategies. Understanding the context of these bond yields is crucial for analyzing future fiscal policies and investment opportunities in the region.

In conclusion, the observation that China’s 10-year bond yields have fallen below 2% marks a significant moment for investors and economic analysts alike. This development not only highlights investor sentiment towards the Chinese economy but also raises questions about future monetary policy adjustments by the Chinese authorities. As economic conditions continue to evolve, close attention to these trends will be vital for navigating investment risks and opportunities.

Original Source: www.ft.com

Post Comment