Bitcoin’s Price Decline: Analyzing Market Influences and Support Levels

Bitcoin has seen a recent decline, falling below $100,000 with a 5% drop in 24 hours, now trading around $96,000. This decline is connected to broader market instability, particularly sell-offs in major U.S. stock indices, which have increased Bitcoin’s sensitivity to traditional market movements. Technical analysis suggests potential support may exist near Fibonacci retracement levels, but risks of further decline remain.

In recent days, Bitcoin has experienced a significant decline, falling below the $100,000 mark for the second time, with a crash of approximately 5% in the last 24 hours. Currently, it has found some support around $96,000, but overall, it has dropped around 10% over the past three days. This trend is attributed to wider market instability, and analysts suggest that a potential price bottom may emerge soon.

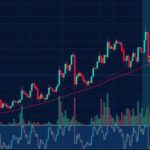

Technical analysis reveals that Bitcoin’s movements are closely tracking Fibonacci retracement levels, indicating that it currently resides within a critical support zone. The analysis shows that historically, the range between the 0.618 and 0.786 retracement levels has provided substantial support for Bitcoin. However, there are concerns that the price may dip further to around $93,800, risking a more severe downturn.

Furthermore, the connection between Bitcoin and traditional finance has become more pronounced, particularly following the introduction of Spot Bitcoin ETFs. Recent sell-offs in major U.S. stock indices, including the S&P 500, Nasdaq, and Dow Jones, have exacerbated the downward trend in Bitcoin’s price. Data indicates that significant outflows from Spot Bitcoin ETFs occurred recently, underscoring the impact of traditional market sentiment on the cryptocurrency.

The fluctuations in Bitcoin’s price have drawn considerable attention, especially as market dynamics between cryptocurrencies and traditional financial assets become increasingly intertwined. Historically, Bitcoin has demonstrated resilience at certain retracement levels, particularly in moments of market correction. The recent downward trend may be reflective of investor sentiment aligned with broader economic shifts and stock market performance, highlighting the risks associated with investing in cryptocurrencies amidst volatility.

In conclusion, the recent decline of Bitcoin below the $100,000 threshold reflects broader market instability influenced by traditional financial markets. As the cryptocurrency hovers near the critical support level of $96,000, analysts suggest monitoring the retracement levels to gauge potential recovery or further drops. Should Bitcoin fall to approximately $93,800, it would necessitate scrutiny to avoid deeper losses that could challenge its recovery trajectory.

Original Source: bitcoinist.com

Post Comment