Bitcoin Reaches $97,000: Examining Potential for Further Bullish Action

Bitcoin’s price has surged to $97,000 while facing consolidation, reflecting both bullish ETF accumulation and retail profit-taking. The trading sentiment is cautious, as evidenced by declining long positions and uncertain market behavior, complicating the path towards a new ATH beyond $110,000 despite positive technical signals.

Bitcoin has recently reached a price of $97,000, coinciding with the milestone of its 16th birthday marked by the mining of its genesis block. Despite this notable price point, the market is currently consolidating within a narrow range, suggesting a potential continuation of sluggish trends in the near future. The notable uptick in spot ETF accumulation, which now constitutes over 5.7% of Bitcoin’s total supply, presents a bullish outlook for the cryptocurrency. Conversely, retail traders are reportedly taking profits from their Bitcoin holdings, indicating a decreasing confidence in the asset’s short-term trajectory. Given these dynamics, the possibility of Bitcoin achieving a new all-time high (ATH) beyond $110,000 remains a topic of speculation.

The market’s subdued performance towards the end of 2024 is anticipated to negatively impact trading behaviors into 2025. However, there is an observable bullish rebound from interim lows near $91,000, hinting at the potential for Bitcoin to reach the coveted $100,000 mark. Despite this, the wave of profit-taking among traders has intensified, contributing to Bitcoin’s continued consolidation. Analyst ALI has indicated that those with long positions have significantly decreased, leading to a drop from 66.33% to 56.85% within 24 hours. This behavior reflects the broader uncertainty among traders regarding Bitcoin’s upcoming price movements, which inhibits the cryptocurrency from surpassing its resistance level just below $100,000.

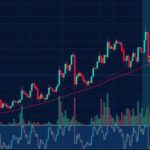

Technically, the market does exhibit signs of bullish momentum, particularly as Bitcoin’s price is testing the critical resistance zone of the 50-day moving average, which is experiencing increased upward pressure. Furthermore, the MACD analysis illustrates a decline in selling pressure, suggesting an imminent bullish crossover. Additionally, indicators from the bullish market support band (BMSB) are also aligning for a similar crossover on the daily chart, which could signal the onset of new bullish activity.

Despite these positive technical signals, it is important to note that Bitcoin is expected to remain in a consolidative phase below the $100,000 mark for the foreseeable future. This is primarily due to a noticeable decline in trading volume across platforms. Concurrently, Bitcoin exchange reserves have plummeted, an indication that market participants may be bullish in the long term, preferring to hold assets rather than engage in trade.

The current analysis of Bitcoin’s price movements is framed by its 16-year anniversary of the genesis block’s mining. The cryptocurrency markets have been experiencing fluctuations influenced by various factors including retail trading behavior, ETF developments, and technical indicators. The market dynamics suggest that while there is potential for growth, numerous indicators such as trading volume and profit-taking practices point towards a cautious outlook as investors weigh the risks associated with potential price movements and market conditions.

In summary, Bitcoin’s recent rise to $97,000 juxtaposed with ongoing consolidation raises questions about future price movements. Although there are bullish indicators on the horizon, including technical analyses suggesting potential breakouts, a significant drop in trading volume and increased profit-taking reflect underlying trader uncertainty. The general sentiment suggests that until Bitcoin can thrive beyond the $100,000 threshold with considerable trading volume, the cryptocurrency is likely to continue in its current state of consolidation, reflecting a complex interplay between optimism and caution among market participants.

Original Source: coinpedia.org

Post Comment