Bitcoin Price Dips Below $93,000 Amid Inflation Jitters and Market Volatility

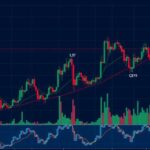

Bitcoin’s price briefly fell below $93,000 due to inflation concerns stemming from macroeconomic data, leading to reevaluations across financial markets. Recent economic indicators suggest inflation remains a concern, influencing investor sentiment and asset valuations, particularly in the crypto space. Bitcoin later rebounded to $94,600 while Ethereum and Solana also saw declines. Analysts emphasize the lasting effects of interest rates on risk assets.

Earlier on Wednesday, the price of Bitcoin experienced a temporary decrease, dropping below $93,000, as reported by CoinGecko. This decline was attributed to concerns regarding inflation triggered by recent macroeconomic data releases. Jake Ostrovskis, an OTC trader at Wintermute, remarked to Decrypt that since the Federal Reserve’s December Federal Open Market Committee meeting, cryptocurrency prices have shown a significant correlation with traditional assets, particularly as the Fed hinted at a more cautious stance on monetary easing anticipated for 2025.

Ostrovskis noted that amid the evidence of a robust U.S. economy, traditional assets have already adjusted to eliminate expectations for Federal rate cuts. This adjustment has notably affected the crypto market, particularly as initial post-election enthusiasm fades. On Tuesday, the Institute for Supply Management unveiled its Purchasing Manager’s Index for the services sector, which exceeded expectations, further fueling inflation-related speculation.

He stated, “Two months ago, no one would even look at this. But because the Fed has put [the] onus on inflation data now, investors and traders are looking at every single bit.” Meanwhile, Cosmo Jiang of Pantera Capital highlighted data from the U.S. Bureau of Labor Statistics showing that the economy is on a strong footing, with an unexpected rise in job openings. Jiang explained that this has prompted a collective reassessment across all markets, leading to the pricing in of a “higher for longer scenario” regarding interest rates.

In the aftermath of Wednesday’s price dip, Bitcoin rebounded slightly to $94,600, marking a 2.2% decline for the day. Concurrently, Ethereum and Solana also faced declines of 3.4% to $3,300, and 4.6% to $195, respectively. According to a note from 10x Research, the prevailing “less aggressive rate-cut trajectory”—and fears surrounding an incoming administration’s capacity to overstimulate the economy—partly underpinned Bitcoin’s drop from its peak of $108,000 in December.

On Monday, Bitcoin had climbed past the $100,000 mark, spurred by speculation surrounding a potential reduction in tariffs. Goldman Sachs Chief Economist Jan Hatzius commented that inflation is likely to decrease more swiftly if the new administration refrains from implementing universal tariffs. In conjunction, the U.S. Dollar Index has approached a two-year high, currently near 113.

Additionally, the 10-year treasury yield, recording a high of 4.681% on Wednesday, is a contributing factor to the pressures on crypto prices, as higher yields make riskier assets like cryptocurrency less attractive. Ostrovskis observed that as inflation concerns resurface, the relationship between bond yields and crypto values is increasingly impactful, stating, “As yield goes higher, the incentive to put money in risk assets like crypto becomes lower.”

Investors are anticipated to receive updated insights into the labor market on Friday with the release of the monthly employment report from the Bureau of Labor Statistics, which is expected to show an increase in the unemployment rate to 4.2% in December.

The cryptocurrency market has been affected by recent macroeconomic data signaling potential inflation concerns, which have prompted investors to reevaluate the market. Bitcoin’s correlation with traditional financial assets has notably intensified since the Federal Reserve’s December meeting, where it suggested a more cautious approach to monetary policy in response to economic conditions. As inflation becomes a focal point, market participants are closely monitoring indicators that could sway the monetary policy landscape, including employment data and economic resilience.

In summary, Bitcoin’s price fluctuation below $93,000 reflects broader concerns about inflation and its relationship with traditional financial markets. Key economic indicators have influenced investor sentiment, leading to significant movements in both cryptocurrency and traditional asset prices. As data continues to evolve, particularly concerning labor metrics, the market will remain vigilant regarding the potential longevity of high interest rates, which could further impact risk assets like Bitcoin.

Original Source: decrypt.co

Post Comment