Solana Reaches Three-Month High as Bitcoin Approaches New All-Time High

Solana reached a three-month high of $180 on October 29, retracing to $178.76, influenced by market trends and a 16.3% monthly price increase. The network’s total value locked (TVL) hit a two-year peak, positioning Solana as the second-largest blockchain by TVL. Bitcoin also saw gains, surpassing $72,000, with the potential to reach a new all-time high amidst growing trading interest.

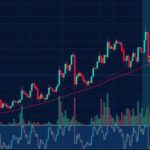

On October 29, Solana (SOL) peaked at $180, marking its highest price in three months, though it has since retraced slightly to $178.76, reflecting a 0.65% decline over the past day. Noteworthy is the asset’s significant downturn of 18.41% in trading volume, contributing to a bearish sentiment. Currently resting on a support level of $178.10, SOL may attempt to test the resistance level of $180.58 again soon in the range-bound market.

In October, Solana reported a 16.3% monthly increase in price, coinciding with an impressive rise in total value locked (TVL) in its network. As of October 26, the TVL reached a record 42.5 million SOL, the highest since September 2022, driven significantly by contributors like Jupiter, Radium, and Sanctum. This surge has enabled Solana to momentarily surpass Binance Smart Chain and solidify its position as the second-largest blockchain by TVL, while narrowing the gap with Ethereum, prompting market speculation about its continued ascendance.

Moreover, Solana has demonstrated robust performance in decentralized exchanges (DEXs), achieving a 19% volume increase over the past week, outpacing competitors Ethereum and Binance Smart Chain. The primary players in this sector include Radium, Lifinity, and Phoenix, showcasing Solana’s capabilities in meme coin trading as well. Positive trends are present in SOL’s perpetual contracts, with a funding rate of 0.01 indicating user demand for leveraged positions, reinforcing a healthy market outlook.

As for user engagement, the number of active wallets surged to 107.04 million on October 26, reflecting heightened transaction activity that typically accompanies price rises. Throughout October, SOL’s steady gains point to a potential price target of $210 if momentum sustains beyond the recent highs. The relative strength index suggests the asset is nearing overbought conditions, yet increased selling pressure could see a dip towards $160.99 or below.

In a related narrative, Bitcoin’s price is also gaining momentum, surpassing $72,000 as of October 30, nearing its former all-time high. The current market capitalization stands at $1.43 trillion, with a dominance rate of 60%. Should this trend persist, Bitcoin could exceed $100,000 by year-end under favorable market conditions. The trading landscape for Bitcoin is evolving as well, with the Gate.io P2P platform allowing users to engage in direct trades, thus enhancing market accessibility and flexibility for participants.

The cryptocurrency market is currently witnessing significant fluctuations with assets such as Solana and Bitcoin attracting notable attention. Solana has experienced impressive gains in its price and total value locked within its network, indicating investor confidence and increasing utilization. Simultaneously, Bitcoin is on an upward trajectory, potentially nearing an all-time high, reflecting overall market optimism and increased trading activity. The introduction of decentralized trading platforms such as Gate.io’s P2P further diversifies trading options for cryptocurrency investors, emphasizing the need for flexibility and security within the trading ecosystem.

In conclusion, Solana has shown resilience with a recent price hike and a promising increase in its total value locked, suggesting a possible continuation of this upward trend. Meanwhile, Bitcoin is poised to challenge its historical price levels as underlying demand grows. Overall, developments in decentralized trading platforms such as Gate.io P2P further enhance market engagement, ultimately benefiting traders and the broader cryptocurrency landscape.

Original Source: www.thecryptoupdates.com

Post Comment