Bitcoin Surpasses $100,000 as Monthly Inflows Reach $80 Billion

Bitcoin has surpassed the $100,000 mark, driven by monthly inflows of $80 billion. The Realized Cap has crossed $768 billion, indicating robust investment interest. Profit and loss metrics reinforce a thriving market for Bitcoin, highlighting significant capital movement in recent times.

Bitcoin has surged back above the $100,000 threshold, bolstered by substantial capital inflows into the asset, which have now reached an impressive $80 billion per month. The founder and CEO of CryptoQuant, Ki Young Ju, commented on the significant increase in Bitcoin’s Realized Cap, which has now exceeded $768 billion. This metric assesses the total market capitalization of Bitcoin based on the last transaction price of each token, reflecting the cumulative investment made by users in the cryptocurrency.

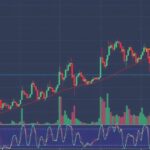

The observed uptrend in Bitcoin’s Realized Cap suggests a vigorous influx of capital within the market. According to Ki Young Ju, “Bitcoin is attracting $80 billion every month; nearly half of the capital that has entered the Bitcoin market over the past 15 years was added this year.” He revealed a chart that illustrates this steady growth trajectory, indicating that demand for Bitcoin remains high.

Additionally, Glassnode’s latest report analyzed metrics such as Realized Profit and Realized Loss to reveal the historical profitability and losses realized by investors. The aggregate profit from Bitcoin transactions amounts to approximately $1.27 trillion, contrasting with realized losses calculated at about $592 billion. This data mirrors the Realized Cap, reinforcing the notion of a thriving investment ecosystem around Bitcoin.

Moreover, Bitcoin’s price recently recovered from a dip below $95,000, making its return to the $100,000 level a significant milestone for investors and stakeholders within the cryptocurrency landscape.

Bitcoin, a digital asset and decentralized form of currency, has seen fluctuating prices since its inception. Its Realized Cap refers to a valuation methodology, accounting for the total value of Bitcoin in circulation based on the price at which each token last transacted. This method provides insights into the overall capital invested in Bitcoin. Tracking inflows, such as the recent $80 billion monthly increases, reflects heightened interest and confidence among investors, contributing to the cryptocurrency’s robust investment atmosphere. The dynamics of profit and loss realization also play a significant role in understanding market behaviors. With the recorded disparities between profits and losses, an analysis of these metrics reveals patterns that can influence future market movements and investor decisions.

In summary, Bitcoin’s resurgence above $100,000 is largely attributed to significant monthly capital inflows. The rapid growth of its Realized Cap, surpassing $768 billion, indicates a robust level of ongoing investment interest. Metrics related to profit and loss further enhance the understanding of Bitcoin’s market dynamics, empowering investors to make informed decisions amidst a thriving cryptocurrency environment. As demand for Bitcoin sustains, its market behavior continues to capture the attention of investors globally.

Original Source: www.newsbtc.com

Post Comment