Navigating Bitcoin’s Uncertain Future: A Reflection on Current Market Trends

Bitcoin currently finds itself in a state of uncertainty, akin to Dante’s Limbo, with fluctuating prices and ambiguous future direction. Since its peak in December 2021, BTC has struggled with significant resistance around $92,000, raising concerns over potential price collapses. However, indications of an accumulation phase, low selling pressure, and evolving dynamics within U.S. markets may set the stage for a possible rebound in the near future.

The current state of Bitcoin (BTC) presents a scenario of uncertainty, as the cryptocurrency floats in a precarious position, reminiscent of Dante Alighieri’s concept of Limbo. This state signifies a temporary suspension, where it is difficult to ascertain a clear direction for its price movements. Although there appears to be potential for awakening, external factors seem to obstruct any definitive progress. Presently, the sentiment surrounding Bitcoin remains rather pessimistic, indicating a challenging phase ahead.

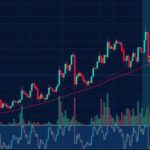

Historically, the Limbo of Bitcoin’s price can be traced back to the pinnacle achieved on December 17, when it soared above $108,000, only to decline to below $93,000 by December 20. Since that downturn, BTC has exhibited a sideways trend, seldom straying far from the $92,000 mark. Attempts to rebound, such as the brief climb above $100,000 on January 6, were quickly reversed, highlighting the stubborn nature of this price support. If this threshold falters, the speculation surrounding a potential collapse toward values around $85,000 or even below $80,000 intensifies.

On a more positive note, there are hypotheses regarding an ongoing accumulation phase. Analysis indicates that, since the second half of February 2024, there has been a steady decrease in the number of Bitcoins available on exchanges, suggesting a reduction in selling pressure. Although this trend appears to have normalized this week, the absence of significant selling indicators contributes to a prevailing sentiment that the market may be preparing for a rebound, contingent upon the resolution of current difficulties.

The financial dynamics surrounding the U.S. dollar further complicate the situation. Presently, the dollar is strong, contrary to expectations, leading many large investors to reassess their strategies. This shift may validate the notion of accumulation, as investors venture out of risk-on assets to bolster their dollar reserves for future investments back into Bitcoin. Consequently, a potential weakening of the dollar could trigger an uptick in Bitcoin’s price, reflecting the inversely correlated relationship that has emerged between Bitcoin and the Dollar Index.

Moreover, the buying pressure has remained low, consequently hindering upward movement in Bitcoin’s price. However, historical patterns reveal that a significant increase in buying pressure could materialize at lower prices, confirming the anticipation of a rebound. A mere 5% drop could initiate this phenomenon. It is essential to recognize that while selling pressure remains subdued, any increase in buying pressure may lead to considerable positive price movements.

The role of U.S. entities has become increasingly vital, as their ownership of BTC has hit record levels. This trend was exacerbated by the launch of spot Bitcoin ETFs on U.S. exchanges in the past year, making it easier for investors to access the cryptocurrency market. Given the dominance of U.S. financial markets on a global scale, Bitcoin’s gravitational center appears to have shifted significantly towards America, amplifying the impact of U.S. financial policies on its price trajectory.

Bitcoin, the pioneering cryptocurrency, has experienced significant fluctuations since reaching its all-time high of over $108,000 in December 2021. The ensuing volatility has resulted in a prolonged period of uncertainty regarding its future price direction. Factors influencing Bitcoin’s market dynamics include trader sentiment, reactions to U.S. monetary policy, and ownership trends among U.S. entities, especially following the introduction of spot Bitcoin ETFs. These elements contribute to shaping the price of Bitcoin as investors navigate a complex landscape characterized by potential accumulation phases and market corrections.

In summary, the current state of Bitcoin reflects a precarious circumstance characterized by uncertainty and market dynamics that suggest a possible accumulation phase. Despite recent negative sentiment and resistance around the $92,000 mark, historical trends and market behaviors indicate potential conditions for a rebound in price should buying pressure increase. The evolving role of U.S. market participation and the inverse relationship with the dollar further complicate these considerations. As investors continue to monitor these dynamics, the future trajectory of Bitcoin remains contingent upon resolving its present limbo. The observation that the price is closely tied to U.S. financial movements underscores the essential interplay between macroeconomic factors and the cryptocurrency market, warranting further scrutiny from stakeholders.

Original Source: en.cryptonomist.ch

Post Comment