Bitcoin Price Forecast: January 10 Analysis and Key Support Levels

Bitcoin (BTC) is trending downwards, currently priced at $93,274 following a 0.37% decline in the last 24 hours. With imminent support at $92,465, a failure to maintain this level could lead to further declines towards $91,000, or potentially lower. Bearish sentiment prevailing in the market suggests sellers outnumber buyers, heightening the risk of significant price drops.

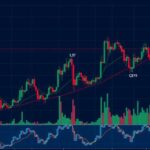

As of January 10, Bitcoin (BTC) is experiencing a downward trend, with a reported decline of 0.37% over the past 24 hours. The current pricing is situated around $93,274, with the cryptocurrency nearing a significant local support level of $92,465. If this level fails to hold, there is potential for further decline towards the $91,000 area. Observations from the hourly chart indicate the risk of a support breakout if bullish momentum does not materialize by the end of the day, possibly leading prices to the $88,000-$90,000 range. Furthermore, the midterm outlook appears bearish, favoring sellers over buyers, with a notable concern should the price breach the $92,118 level, which may trigger a move toward the $80,000-$85,000 zone.

Bitcoin (BTC) prices are influenced by market sentiment and trader behavior, with current developments indicating bearish pressure across the cryptocurrency landscape. A comparative analysis reveals many coins are operating within the red zone, suggesting a broader downtrend. Understanding price levels and support zones is critical for traders aiming to navigate volatile market conditions effectively. Thus, continuous monitoring of these metrics is essential as they provide insights into potential price movements and market dynamics.

In summary, Bitcoin’s current market situation indicates a potential continuation of the downward trend, with core support levels under threat. The prevailing market dynamics suggest that sellers are in control, raising concerns for imminent price instability. Traders are advised to exercise caution and remain vigilant regarding ongoing market trends and support levels, particularly around $92,465, which may dictate future market movement.

Original Source: u.today

Post Comment