Bitcoin’s New Investor Demand Indicates Potential Price Recovery

Bitcoin has recently experienced a decline, with the $92,000 support level in focus. Data shows a significant rise in new investor demand, with 49.6% of wealth held by coins under three months old. The RSI indicates oversold conditions, suggesting a potential price recovery towards the $103,200 resistance level.

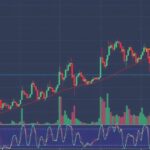

Recently, Bitcoin has faced significant pressures, with a notable decline centering around the critical support level of $92,000. However, new data from Glassnode indicates an increase in demand from new investors, as approximately 49.6% of Bitcoin is now held by coins less than three months old. Moreover, technical analysis shows that Bitcoin’s Relative Strength Index (RSI) is currently in an oversold condition, suggesting a potential price recovery may be imminent. If Bitcoin rebounds, it could aim for the resistance level of $103,200, marking a possible turnaround in market trends.

The cryptocurrency market is notorious for its volatility, and Bitcoin’s recent struggles illustrate this characteristic. While the attempt to maintain upward momentum has met with downward forces, the influx of new investors represents a significant shift in market dynamics. This new participation may absorb the selling pressure typically exerted by seasoned investors. The rising interest from newer market entrants could stabilize the price, which indicates a possible resurgence of investor confidence.

From a technical perspective, the oversold conditions indicated by the RSI on Bitcoin’s four-hour chart signal that a reversal could be on the horizon. Although an oversold RSI alone does not ensure an immediate rebound, it often forewarns that a corrective phase may emerge soon. Accordingly, if Bitcoin manages to recover, traders will focus on the resistance level at $103,200. This area has been pivotal historically, setting the stage for further bullish potential should it be tested successfully.

In the coming days, the significance of the $92,000 support level cannot be overstated. Retaining this threshold may lead to a bullish rally towards the $103,200 resistance level. Conversely, failure to hold this support could precipitate a continuation of the downward trend, with market sentiment remaining divided between caution and optimism. The short-term performance of Bitcoin will be telling in determining whether recovery or further declines lie ahead.

The cryptocurrency landscape is characterized by its inherent volatility, particularly Bitcoin, which frequently witnesses sharp price fluctuations. It is vital for investors and analysts alike to monitor key support and resistance levels to ascertain potential market movements. The support level at $92,000 has become crucial for Bitcoin, serving as a potential pivot point for future price performance. Furthermore, recent trends in investor behavior—specifically the rise of new investors holding a significant portion of Bitcoin—may indicate a shift in market sentiment, offering insights into future price actions.

In summary, Bitcoin’s current market dynamics reveal both challenges and opportunities. The increased demand from new investors could offer a buffer against further declines, while the oversold RSI suggests the potential for a price rebound. Observing Bitcoin’s performance around the critical $92,000 support and $103,200 resistance levels will be essential over the coming days to gauge the likelihood of a recovery amid ongoing market volatility.

Original Source: www.tronweekly.com

Post Comment